Guide for Reducing Financial Leakage in Contract Workforce Management

Download E-book

Payroll Management

Accurate Payroll,

Every time In Single Click

Ascent Payroll simplifies domestic & expat payroll with 100% compliance and accuracy all in one click. With built-in intelligent audits, get precision and efficiency, no matter how complex your workforce may be.

2000+

Enterprise Customers

2M+

Managed Workforce

60 Days

Satisfaction Guarantee*

Join 2,000+ Industry leaders

Managing their Workforces with Precision

Ascent Payroll Software

Powerful Features, Effortless Payroll

Comprehensive Payroll Management

Run payroll confidently, on time and fully compliant every cycle.

One-Click Payroll: Integrates with leave and attendance data, ensuring error-free payouts at the push of a button.

100% Accurate Compliance: Automates TCS, eTDS returns and PF-ECR updates to ensure adherence to the latest regulations.

Trusted by “Big 4”: System audited & approved by Big 4 for unmatched accuracy.

Finance-Centric Reliability

& Insight

Streamline finance operations and drive strategic growth.

Automated Payroll Processes: Automatically configures salary JVs and earning/deduction formulas for precise pay runs: Simplifies loans, advances, and monthly disbursements with integrated processing.

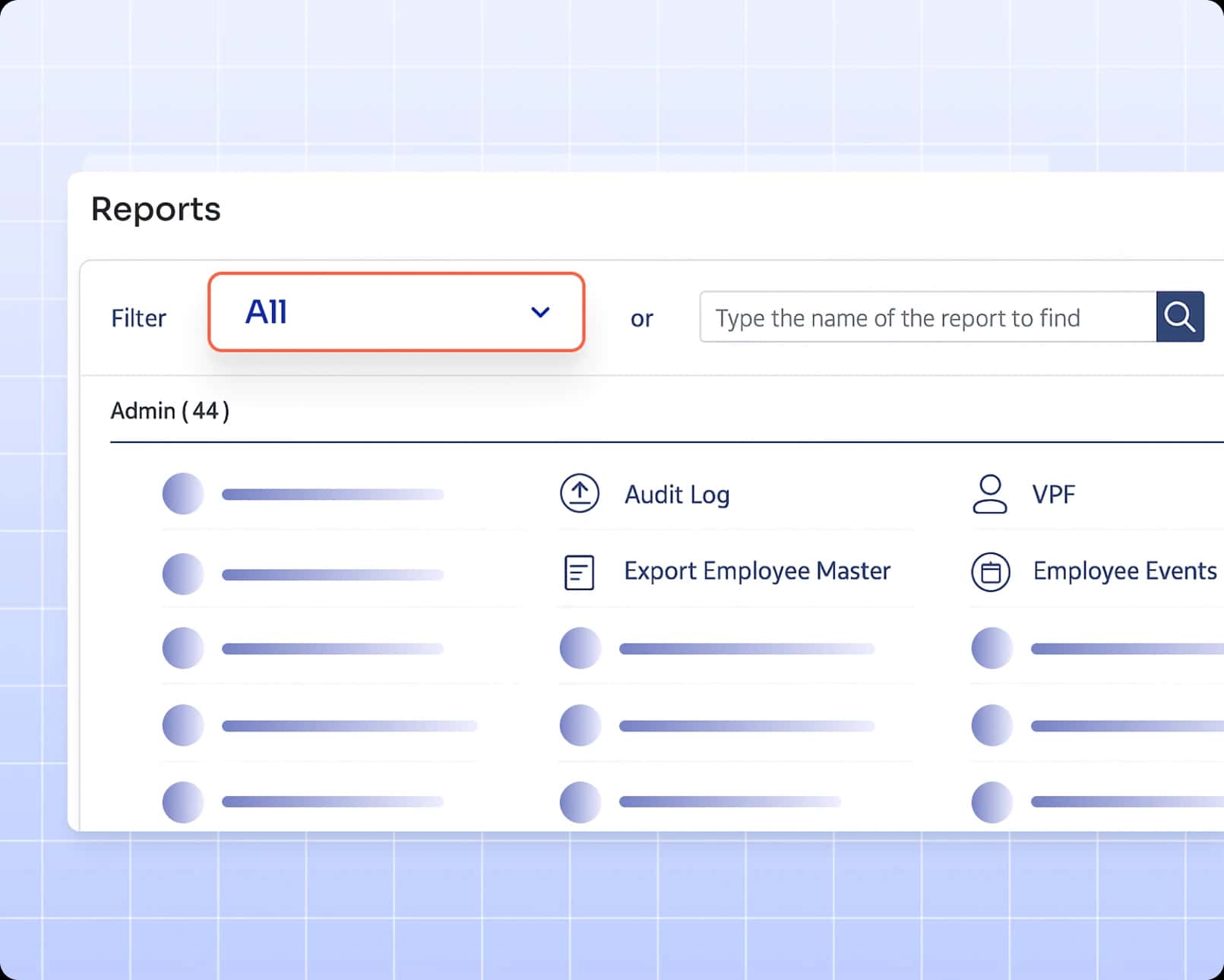

Custom reports without IT support: Access 50+ standard reports and create custom views using 200+ parameters without any help from IT.

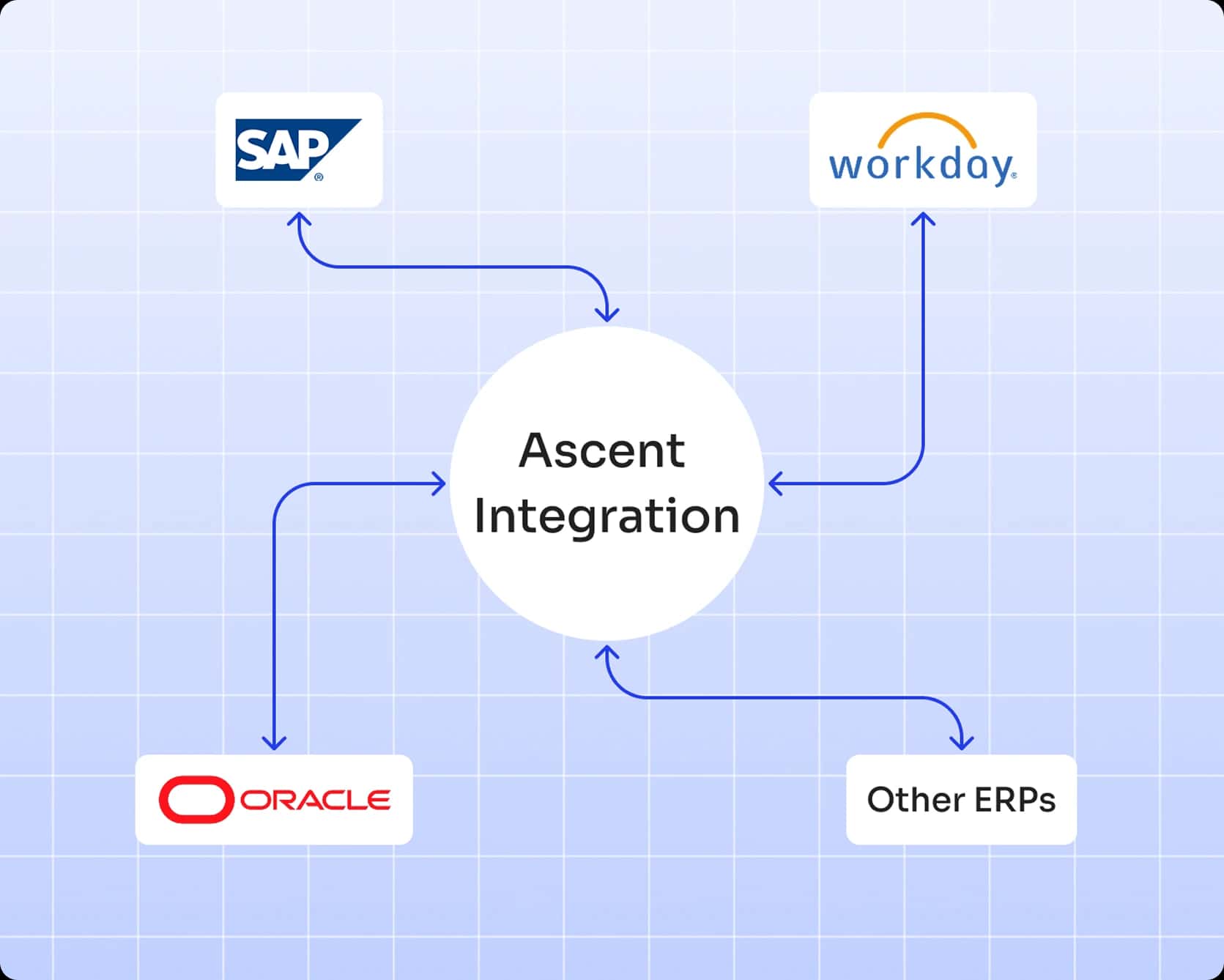

Seamless Integrations: Integrates natively with SAP, Oracle, Workday and other ERPs.

Flexible Bank Management: Ensures secure payments through host-to-host bank integrations and automatic bank file generation with all major banks.

Industry's First Expat Tax Engine

Simplify international payroll with the leading expat tax solution.

Automatic Grossing Up: Ensures accurate tax calculations for expat salaries.

Complex Tax Handling: Manages intricate tax-on-tax scenarios for a global workforce.

Global Compliance: Maintains adherence to the latest international taxation requirements.

Tax Optimization: Maximizes compensation accuracy through automatic tax optimization.

HR Accountability & Efficiency

Streamline administration, ensure clarity and maintain data integrity effortlessly.

Verified Workflows & Audit Trails: Multi-level approvals and timestamped tracking provide full transparency and accountability for all system changes.

Automated Settlements: Bulk automates exit processes to reduce manual effort and ensure accurate full and final settlements.

Custom Variance Reports: Easily reconcile data, detect issues early and streamline approvals.

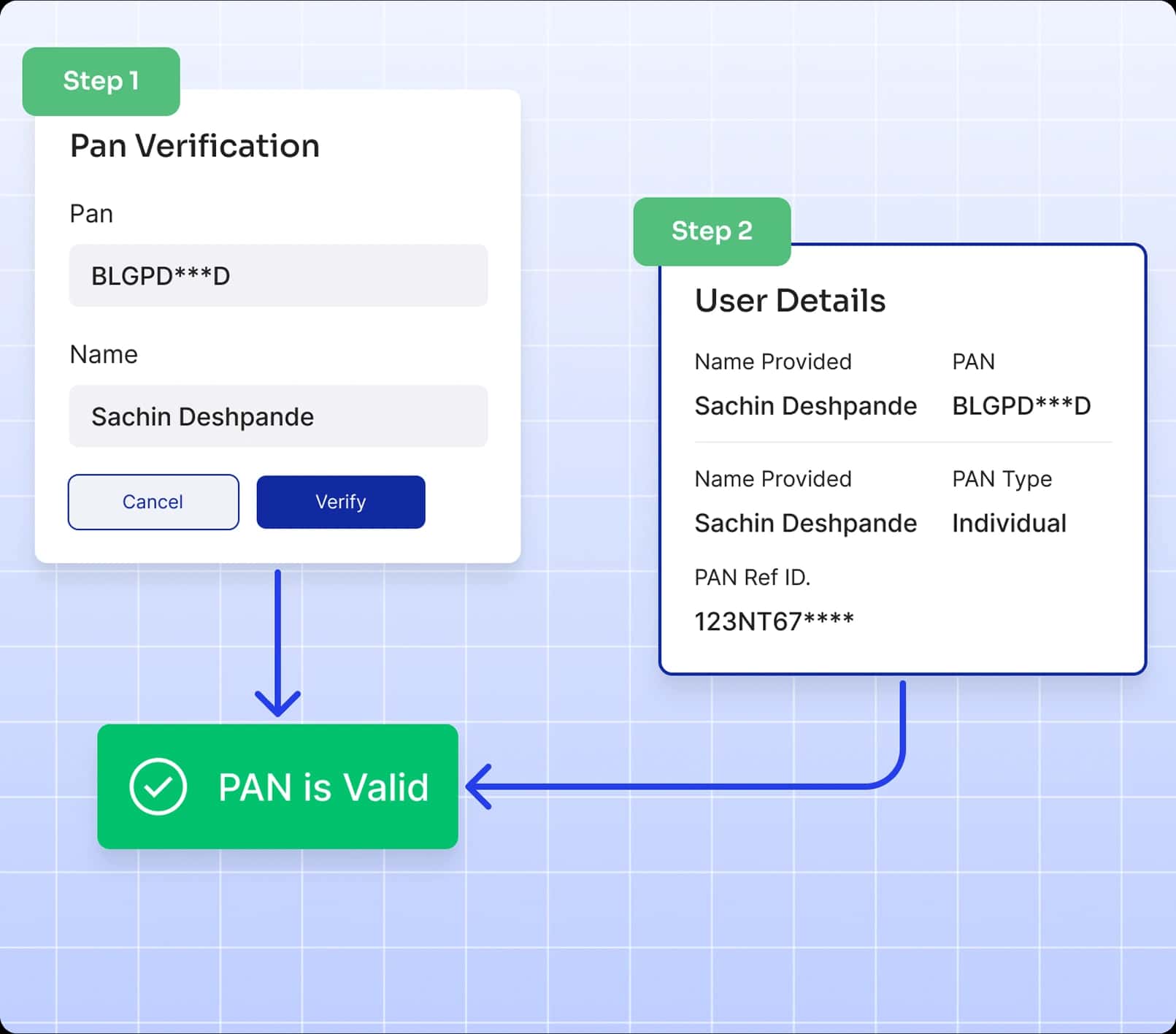

Smart Data Validation: Automatically detects duplicate bank accounts and missing details, performs real-time PAN & Aadhaar validation and ensures all compliance documents are complete.

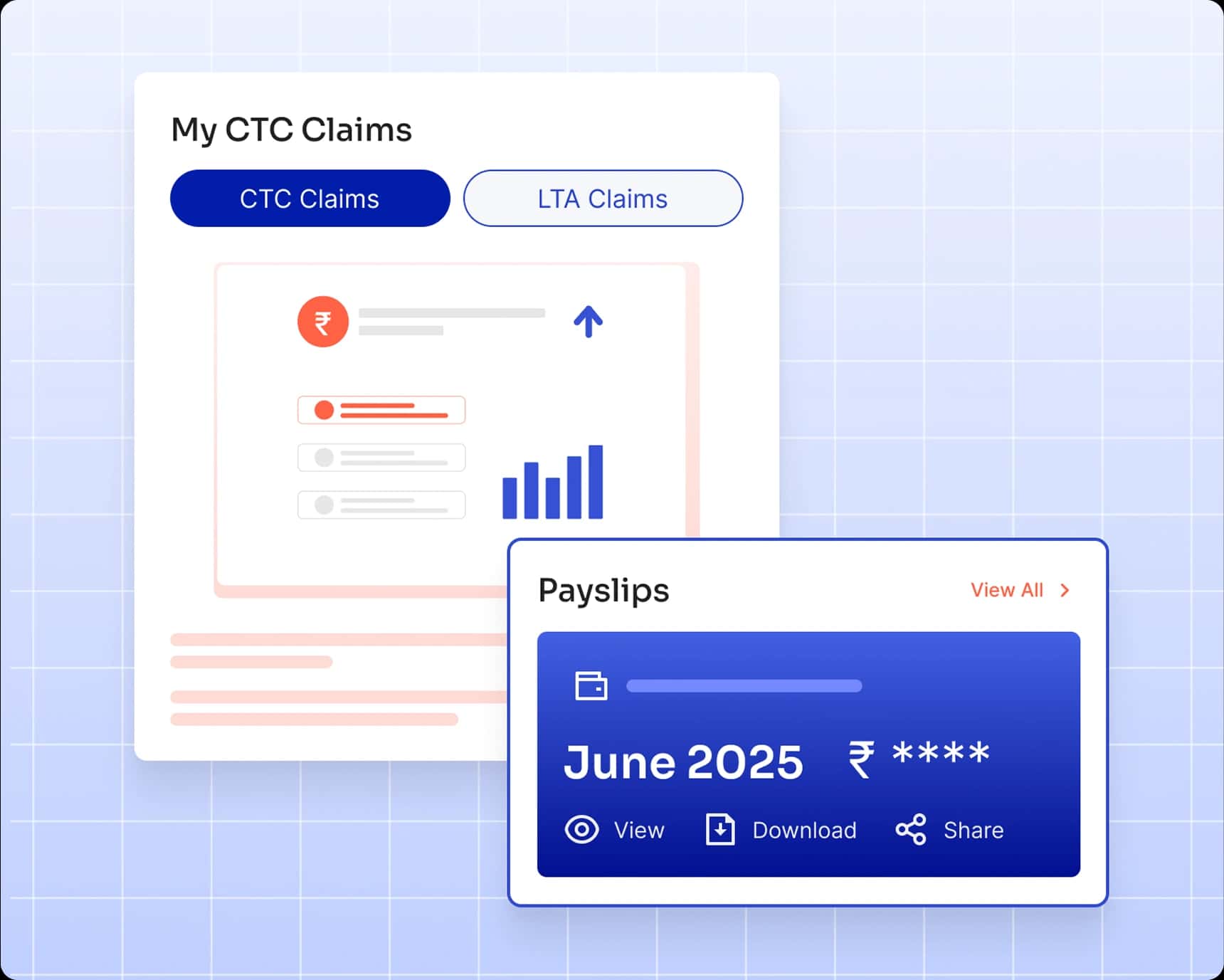

Seamless Employee Self Service

Empower employees with seamless, self-managed payroll tools.

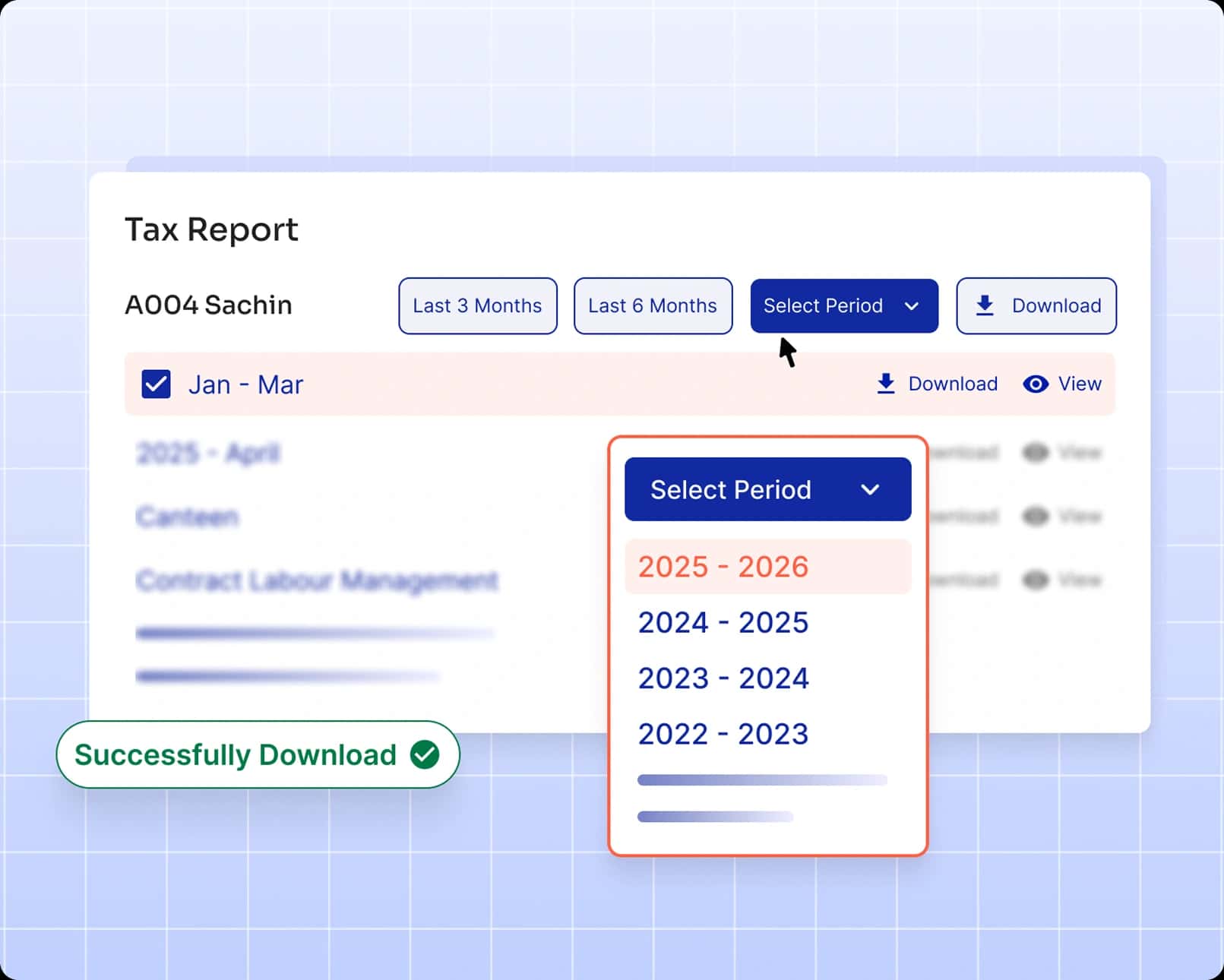

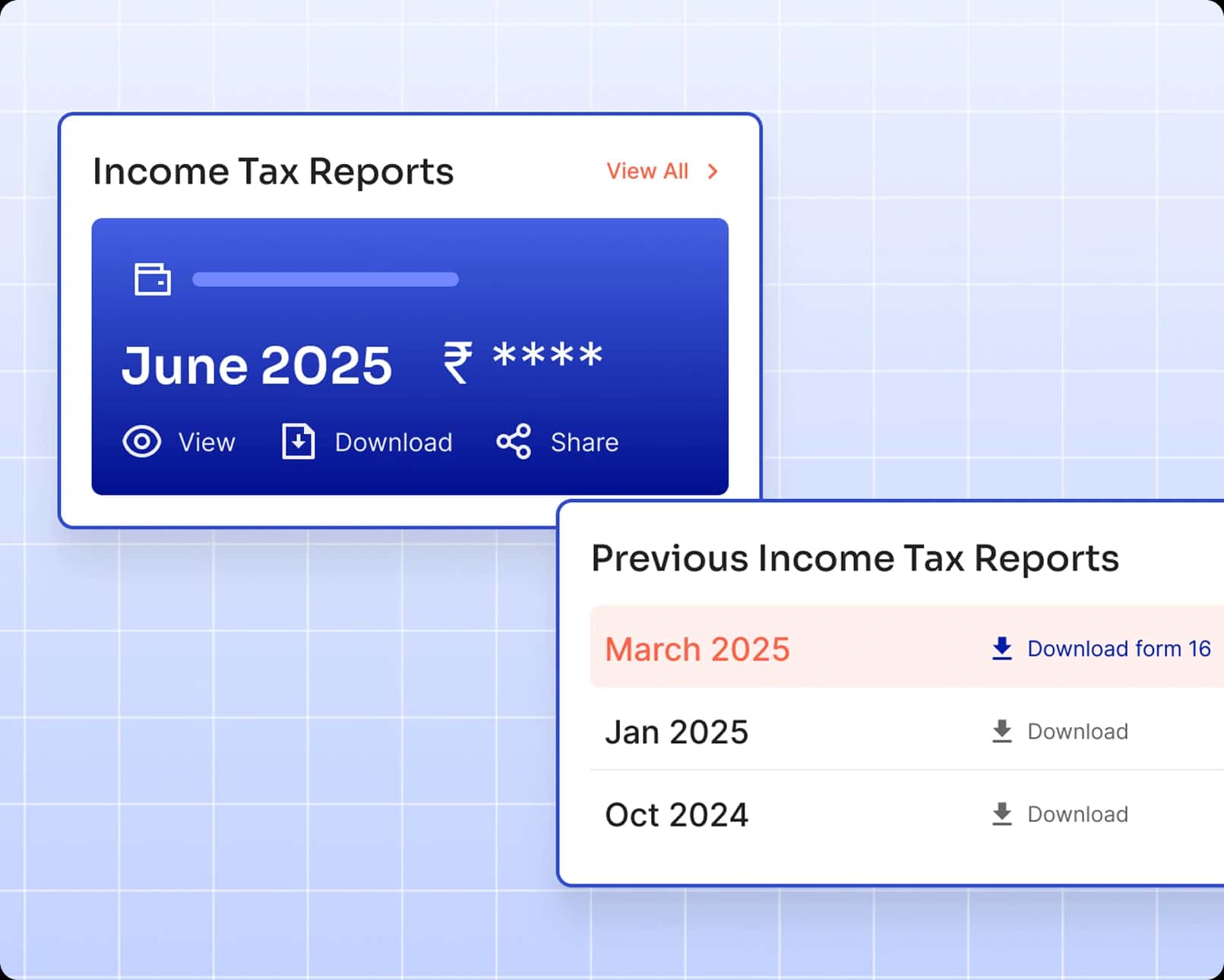

On-Demand Payslips & Form 16: Instantly delivers digital payslips and tax documents, eliminating HR’s involvement.

Mobile-Friendly & Secure Access: Offers a secure, intuitive platform accessible from any device, ensuring convenience and trust.

Alumni Portal: Maintain connections with former employees through a dedicated portal, providing them access to their payroll information and company updates.

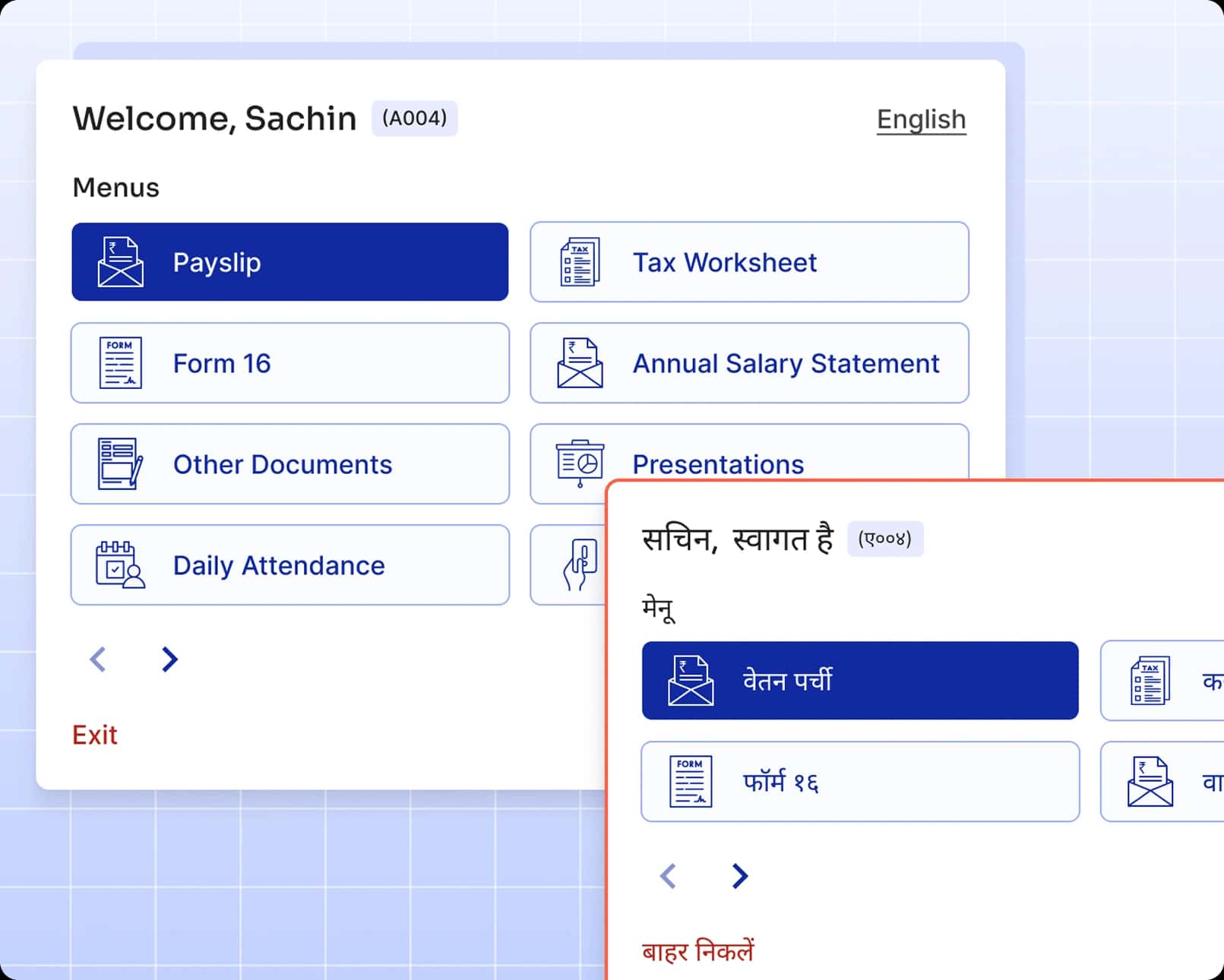

Kiosk App:

Access Without Boundaries

Empower on-site and field employees with multilingual, self-service kiosks.

Multilingual Interface with 9 Languages: Accommodates a diverse workforce, providing information in employees’ preferred language.

Biometric Authentication: Enhances security and simplifies login, reinforcing confidence in data integrity.

Instant Data Retrieval: Delivers essential payroll and attendance details instantly, reducing HR workloads and boosting workforce efficiency.

Always Up-to-Date

with Statutory Compliances

Stay aligned with evolving regulations, no extra effort required.

Auto-Generated Returns: Handle ITNS 281 Challan, Form 16, LWF and ESIC forms directly within the system.

Automatic Compliance Updates: Adapt to changing government regulations with continuous, real-time updates.

60 Days Satisfaction Guarantee

& Expert Support

Customer service is our highest priority and we stand firmly behind everything we deliver.

Eilisys offers an exclusive 60 days Satisfaction Guarantee.

Why Choose Ascent Payroll?

Unmatched Accuracy

Smart Audit Features

Built-in Validation at Every Step

Automated Compliance Checks

Robust Security

Multi-level Controls & Encryption

Regular Audits & Global Standards

Role-Based Access Restrictions

Expert Support

Proficient Implementation Team

Dedicated Weekday Support

Regular Free Training Sessions

Ready to Transform Your Payroll?

Schedule a personalised demo to see how Ascent Payroll can streamline your payroll operations while ensuring 100% accuracy and compliance.

Request A DemoFrequently Asked Questions

Get answers to the most common questions about Ascent HCM Software, from integrations and compliance to security and satisfaction guarantees.